Leaderboard

Popular Content

Showing content with the highest reputation on 12/31/22 in Posts

-

Objection, John! Imo amplitude is just 2nd place, after the main topic: beat error. Frank3 points

-

2 points

-

I have the Weishi 1000, without the gain setting. I try to get the balance as close to the metal clip as possible, or if cased, put the crown against the metal clip. I either get no signal, or the amplitude looks OK. I don't remember seeing any discrepancies. After a while you get enough experience to judge "good" amplitude just by looking at the balance/hairspring movements.2 points

-

This is watch repair everything is possible. But on an American pocket watch the balance hole jewel typically is fixed where it goes in. You want to change his location you need some tools and a lathe to trim down the setting to get it closer in. So in this particular case moving them around is not a practical option. But in some watches you may be able to move the jewels around. But ideally it would help to put the correct balance staff in and adjust its pivots to the situation. I suspect some watches they deliberately made their balance staff pivots long to compensate for these problems and in the watchmaker was supposed to adjust the pivots. But that would assume a watchmaker had a lathe to do that which a lot of them do not.2 points

-

2 points

-

No it can not, the crown stops turning at the full wind. If it does not stop, then spindle or arbour has lost grip. Open a manual wind barrel, to see how it works. Do not please hesitate to ask your questions and pictures help. Rgds1 point

-

1 point

-

1 point

-

What you're curious what if you take the quest for amplitude to the next perfection the next level the 300s you want to go to the loyalty of amplitude adjusters what would be the consequence? The consequences would be exactly what I saw at work. -2135 Rolex watch it's been sitting next the timing machine for several weeks vacation asked why is this still here? All the paperwork indicated it was finished well almost completed servicing it was on the auto winder and it has just a minor problem maybe the customer wouldn't care. So my observation was when I was winding it up I could feel when it hit the end in it was slipping on the breaking grease it seemed like a little more force that should. Then those golden magical 300° amplitude was trying a member of Ohio was? Might've been 311 Saudi outstanding with nets except and yes it hit 300+ only halfway into winding it and was really nice it really didn't go beyond the 300 I think 311 it was where it several that it might've been 331 I can't quite remember but a case it was magical except as a consequence unfortunately our favorite YouTube channel it shows this has disappeared but what happens is with too much amplitude in this particular case the watches running 10 minutes a day fast. It's why Rolex and almost all the other watch companies 300 Max they went to safely away from bad things. Because one thing what happens is the balance will come along and whack the backside of the fork that's not good for the roller jewel but in this particular case the watches just run insanely fast. Fortunately in the case of Rolex they anticipated this so a $40 mainspring has been ordered from eBay that's considered a weaker spring so it's an original Rolex spring that's just a little bit weaker to solve that problem. So yes you can go too high if you go too high it leads to timing consequences but who cares about timing consequences you achieved the 300s who cares at the customer be very angry that their precision chronometer grade Rolex watch is now running 10 minutes a day fast I wonder if that would be a problem?1 point

-

I had a similar problem with as As 1701- everything looked good and I couldn't get amplitude above 230°. (Like prasezis and JohnR725 I'm not fanatical about amplitude and beat error, but I like to see at least 240° when everything is looking good). Like yours, the lock of one pallet jewel was too deep. At Nickelsilvers' suggestion, I pushed it in a bit (easy to do) - and I gained 45° amplitude to 275°. https://www.watchrepairtalk.com/topic/24872-as-1701-this-may-have-me-beaten-what-can-i-do-next/1 point

-

I have learned the hard way that TMs should be taken with a big pinch of salt, at least the Chinese ones, and maybe even the expensive Swiss ones(!?). I have had several examples where the amplitude has been shown wrong (always too low in comparison with reality). You have to get the gain setting on the TM right to get near the truth. I still remember being very disillusioned about an Omega cal. 268 until you suggested I'd take a slo-mo video of the balance which proved the amplitude was fine and the TM was off. The amplitude demands almost killed my interest in watch repair. I've had several movements that I put my heart and soul into which still didn't reach the "WRT amplitude standard" but still proved to be excellent timekeepers in the end. I have developed a very different attitude towards amplitude, which has helped preserve my interest. It may or may not make a substantial difference. I'd wear it for a month to see how it fares as a timekeeper. If it fares well, you may not want to touch it, and if not I definitely think it's worth a shot. Personally, I would adjust the jewels either way for the satisfaction of knowing that the jewels sit as they should. It is not as fiddly as it may seem (and I'm not saying that in an attempt to impress anyone). A practice round (or possibly two) on a scrap fork should be enough to give you the required experience to do it on your precious Omega.1 point

-

That's a good video, and explains things clearly. Worth remembering for when others ask about adjusting Etachron.1 point

-

You know it be really nice is a picture. The problem is what looks obvious to you may not look obvious to us based on our experiences so having a picture of exactly what were talking about would be quite helpful.1 point

-

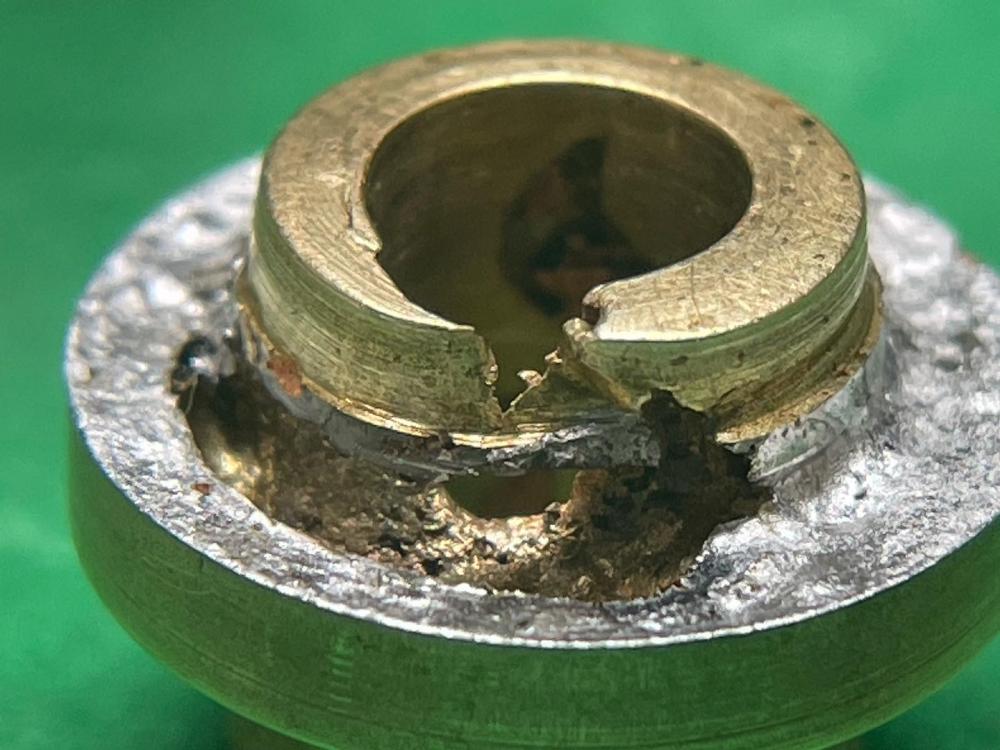

I assume if you put a better running watch on the machine the lines are actually straight and not wobbling around? Usually stuff like that could be lack of lubrication on the escapement perhaps? In a case the line should be more straight. Yes that's a problem. It's why I tend not to like to even touch the collet on pocket watches because either end up being a loose which you can tighten sometimes or they magically crack sometimes you get it to stay in place and work other times that's a definite problem. Actually a bad idea. In the case of balance jewels like this you really can't change their position at all. The best solution is to restore things back to the factory remove the indents remove the dial washers remove whatever is there. Then new balance staff probably or possibly shortening the pivots depending upon how much needs to be shortened. Or sometimes just leave well enough alone of everything seems to be working.1 point

-

The SW200 is supposed to be a clone of the ETA 2824. If it is a true reproduction of a 2824, then the stem has to be in the setting position before removal. In my opinion, the keyless works of the 2824 has to be one of the most problematic designs ever. It was what started me in this fascinating and frustrating hobby. I dislodged the winding pinion when inserting the stem and couldn't get it back in. Another time, I used a tweezer to push the setting lever down to remove the stem and must have used too much force. The entire setting lever disappeared into the movement. If you haven't encountered either of these problems yet, then you must either be very lucky or a watchmaking prodigy.1 point

-

Taking Back Control: The Cousins/Swatch Case and Why the Government and the Courts Should Reject Participation in the Lugano Convention Julian Maitland-Walker (Maitland Walker LLP)/September 23, 2022/Leave a comment The Lugano Convention 2007 is an international treaty negotiated by the EU on behalf of its Member States with Iceland, Norway and Switzerland. It seeks to clarify (inter alia) which courts have jurisdiction in cross-border civil and commercial disputes. The UK ceased to be a Member of the Convention upon Brexit and its attempt to rejoin the Convention has so far been rejected by the EU largely on political grounds relating to the ongoing dispute with the UK over the Northern Ireland Protocol. A recent cross-border dispute relating to alleged breaches of UK and EU competition law currently before the Swiss Federal Supreme Court (FSC) offers a stark lesson on the shortcomings of the Lugano Convention. It suggests that the UK Government and the English Courts should think twice before contemplating rejoining the Lugano Convention, at least while these jurisdictional deficiencies remain. Cousins Material House Limited (“Cousins”) is a family-owned business acting as a Business to Business wholesaler of parts, consumables and tools for the watch repair and jewellery trades. It employs 60 staff and has a turnover of £11 million. Cousins has in excess of 12 million items across 130,000 product lines in stock and offers a unique one-stop shop supply service across all watch brands to independent repairers across the UK. Swatch Group is the largest manufacturer of Swiss-branded watches which it sells all over the world owning dozens of major watch brands including Omega, Tissot and Longines. It employs around 35,000 people worldwide and has an annual turnover in the region of £6 billion. In 2014, Swatch Group announced that with effect from 31 December 2015, it would no longer supply independent wholesalers or independent watch repairers with watch spare parts or movements in the UK. This included Cousins, a long-standing Swatch customer for many years. The supply of Swatch Group watch spare parts represented a significant proportion of Cousins’ turnover and Cousins was the main source of spare parts for independent repairers in the UK. Swatch’s stated objective was to improve the quality of the servicing and repairs of its watches. From a competition law perspective, the concern must be that such a strategy would extend Swatch Group’s market power downstream into the repair and maintenance of Swatch brand watches which (self-evidently) could no longer be carried out by independent repairers if they had no access to spare parts. It is settled law that it is an abuse of a dominant position for a manufacturer of raw materials to refuse to supply those raw materials to an existing customer for reprocessing into a downstream product where the manufacturer has decided to supply the product itself, thereby extending its dominance into the downstream market. [1] Cousins issued a letter before action to Swatch in March 2016. Swatch’s reaction was to request additional time to respond to the claim. Extra time was granted but rather than using the time to examine the merits of the English proceedings, Swatch, without notifying Cousins in advance, went ahead and launched parallel proceedings in the Berne Commercial Court in Switzerland seeking a Declaration of non-infringement in relation to its decision to refuse supplies of spare parts to Cousins. This litigation “torpedo” was presumably launched to remove the risk of proceedings in the English Courts and to secure a trial of the issue in the Swiss Courts where no doubt Swatch was confident that it would receive a more ‘sympathetic’ hearing. The infamous “Italian torpedo” tactic exploits the “Court first seized” rule under the Lugano Convention which would require any English Court proceedings to be stayed pending the Swiss Court’s ruling on the Declaration. Had the UK not been a party to the Lugano Convention by virtue of its EU membership at the time that the Application was made, the English High Court would not have been prevented from proceeding with Cousin’s Application. Cousins’ attempts to challenge the admissibility of the case in the Swiss Court and the jurisdiction of the Swiss Courts were unsuccessful and in December 2021 the Berne Court delivered its judgment six years after the Swiss proceedings were first issued. This judgment is currently on appeal to the Swiss Federal Supreme Court. In essence, the Berne Court found as follows: That the EU Case Law established that spare parts for each branded product is a market in its own right and that there is no substitutability of parts between brands and consumers require the use of original parts to maintain the value of their watches. The relevant market comprised (inter alia) the UK market for the supply of original spare parts for prestige watches of the respective Swatch brands; Swatch is the sole source for the purchase of these spare parts; Swatch had eliminated all competitors in the relevant UK market and now enjoys a 100% monopoly for the supply of Swatch spare parts to repairers. Despite these findings, and notwithstanding the prior case law of the Courts of Justice of the European Union and the English Courts, the Berne Court concluded that this conduct by Swatch was “objectively justified” under EU and UK competition law. In reaching these findings, the Berne Court made several fundamental errors in EU and UK competition law summarised below. First, in assessing the question of “objective justification,” the Berne Court chose to ignore the fact that under the case law an essential legal prerequisite to allow a termination of supply by a dominant undertaking was that it should not, thereby, eliminate effective downstream competition, which was the clear and inevitable result of its actions in this case. This error was all the more glaring given that, as noted above, the Berne Court also accepted that Swatch was a monopolist in the supply of spare parts for its own brands of watches. Second, the Berne Court failed to carry out any assessment as to the effect that Swatch’s decision had had on the UK market. It was for Swatch to prove that its actions did not have a detrimental effect on competition and consumers and yet Swatch produced no evidence in support of its case based on the actual impact of the refusal to supply in the UK. Not a single English witness was called in the proceedings and yet the Berne Court delivered a judgment in favour of Swatch having major implications for the UK, its wholesalers and final consumers without any reference to the local market conditions. Indeed, the evidence produced by Cousins shows that withholding supplies of watch parts had led directly to a serious reduction in the number of independent watch repairers and a very substantial increase in the cost of repairing Swatch watches through Swatch’s approved repairers. This evidence was simply ignored. The Berne Court could have called for market evidence to establish the facts but failed to do so. Third, contrary to more than 50 years of EU and UK jurisprudence, the Berne Court reached the untenable conclusion that the degree of Swatch’s market power in the supply of spare parts (i.e., its monopoly position) is irrelevant to the assessment of the objective justification for the refusal to supply. In reaching its decision, the Berne Court wrongly claimed that it has not yet been decided under European Competition law whether reorganising a dominant company’s distribution arrangements could constitute justification for a refusal to supply. In fact, the ECJ case law has consistently condemned the refusal to supply existing customers by dominant undertakings. The Berne Court argued that the EU Courts had, however, “tentatively” suggested that an internal reorganisation by a dominant supplier of the distribution of goods could constitute a justification for a refusal to supply existing customers and cited the EU Court Judgments in BP v Commission [2] and the Opinion of Advocate General Colomer in Sot. Lélos kai Sia. [3] in support of that contention. Neither of these cases in fact supports the Berne Court’s claim. Although it is the case that BP had carried out a reorganisation of its activities in the Netherlands in 1972 when a large part of its production facilities were nationalised, the issue before the Court, in that case, had nothing to do with the reorganisation. The central question was whether BP was entitled to apply different supply conditions to regular customers as opposed to occasional customers as a result of the 1973 oil crisis. Not surprisingly it held, on the facts, that BP was entitled to offer different conditions of supply to non-regular customers. But here, as noted, Cousins was a long-standing customer of Swatch and was therefore entitled to continuity of supply. In relation to the Advocate General’s Opinion in Lelos, the first point to make is that it was not a Judgment of the ECJ and represents no more than the personal opinion of the Advocate General. The second point to make is that the Case was concerned with the special features of the regulated medicines market and concerned the extent to which supply restrictions imposed to prevent parallel exports might be justified as a means of preventing shortages in the domestic market. Contrary to the Berne Court’s suggestion that the Advocate General was seeking to justify a refusal to supply, he in fact states the opposite at para 115 that it would be abusive to apply a practice which eliminates competition in distribution within Europe by suppressing exports from Greece. The contrary interpretation applied by the Berne Court is plainly wrong. Cousins has appealed the judgment of the Berne Court to the Swiss Federal Supreme Court. The risk is that the Federal Supreme Court will simply endorse the Berne Court’s decision on the facts. The case illustrates that it is both unjust and impractical for cases to be heard in a foreign court where they concern an infringement of local law with which the foreign court concerned may be unfamiliar and may be keen to support an important local industry. The risks of injustice are increased in such circumstances by the aggrieved party having to cope with foreign law, a foreign language in a foreign Court. In addition, it is both unfair and unjust for prospective defendants in matters properly brought before the English Courts to fall victim to such “torpedo claims” whose sole purpose is to deprive claimants of access to justice in the appropriate forum, to delay proceedings and in some cases secure the wrong decision through the pursuit of national interest in a foreign court. In particular, in the Cousins case, all of the key market effects on Cousins, other wholesalers, wholesalers’ customers, and final consumers arose in the UK and, yet, as noted, the Swiss court heard no evidence from UK witnesses. On a wider level, the facts of the Cousins case raise questions as to the apparent enthusiasm of the UK Government to rejoin the Lugano Convention. One may reasonably ask why it is that those advocates of Brexit with their call to arms of “bringing back control” and who are now in control of government should be promoting a cause which will give foreign courts once more the right to rule on matters of English law directly affecting the UK producers and consumers. If and when the EU agrees to allow the UK to rejoin Lugano – and given the current French opposition, it is likely to be a long wait – rejoining must surely be subject to changes in the current Convention which allowed the use of the Swiss torpedo in the Cousins case. The Brussels (Recast) Regulation, which also covers issues of competing for jurisdictional claims, provides at Article 31(2) an attempt to restrict the use of torpedo-tactics. It would be desirable to introduce similar constraints on torpedo-tactics if Lugano is to be acceptable to the UK post-Brexit. _________________ [1] See Commercial Solvents v Commission (1974) ECR 223; also Napier Brown/British Sugar OJ1988 L284/1; Upton Cash Registers/Hugin OJ1978 L22/23. [2] Case 77/77 ECR (1978) 141. [3] Delivered 1/4/2008 ECR (2008) 180. _________________ Maitland Walker LLP advises Cousins Material House Limited in these proceedings. Any opinions or conclusions provided in this blog entry shall not be ascribed to Maitland Walker LLP or any clients of the firm.1 point

-

Today I received this beauty, a 4th quarter 1951 Molnija. In 1947 the Soviets bought the Swiss Cortebert machinery (cal: 624 & 616). In the beginning these movements were produced to the same high Swiss standards, complete with Geneva stripes. In the 1940's Rolex also used the same movement design in their watches. The Molnija movement I received is the same as the Cortebert cal. 624 The seller revealed that this watch has been in his family for as long as he could remember. The watch shows hardly any signs of use / wear and the movement has perhaps been serviced ones, but is still in excellent / untouched condition. It came with the original box, chain and April 1952 passport. Even the inside of the back-lid is highly decorated. And here the 1940's Rolex version;1 point

-

Without a loupe any adjustment is problematic . Before attempting any adjustments get good magnification1 point

-

You shouldn't say things like this on this group where amplitude is the most important thing and timing is of no real consequence at all. Yes there was a discussion a while back where they were obsessed with amplitude and I finally asked about the timekeeping but that was not the most important aspect of the watch running it was the amplitude.1 point

-

Should be, but on a production piece from several decades ago entirely possible that stuff slips through. They didn't have amplitude reading on the machines then (with some exceptions), it probably "kept good time" and off it went. This was always an issue for me doing vintage work for a major maker (vintage being older than 40 years- going back to 1900); they still wanted 270 min horizontal and a delta of 30s max, on some really tiny calibers 100 years old. They would pay for it, but in some cases after 40h of work they'd say "ok good enough".1 point

-

1 point

-

0 points